Managing payroll on your own seems simple and easy in the beginning. That is, until your team focuses on damage control instead of growth because of some missed update, misread rules, or late filings. One of the major oversights with this is assuming payroll only involves paying salaries. When in reality, it also includes compliance, employee trust, and business stability. Among most business types, SMES feel this pressure the most. That’s why payroll outsourcing is the best solution.

As of now, payroll faces rising compliance expectations, stricter labour laws, Emirati labour law updates, and growing cost pressures. This affects how companies manage wages, leaves, and benefits. For small and mid-sized businesses, keeping payroll in-house often means handling too many spreadsheets, software, and stress. Payroll outsourcing steps in as a scalable solution that removes the noise and lets you focus on running your business.

What is Payroll Outsourcing?

Payroll outsourcing means you hand over payroll tasks to a specialized provider that manages salary calculations, filings, reporting, and compliance on your behalf. You still make decisions and approve salaries, but without having to fix formulas or spending time second guessing anything.

The difference between in-house payroll and outsourced payroll is evident in how in-house teams manage software, updates, audits, and backups internally. Whereas, outsourced teams already run payroll systems for accuracy and scale.

Across the UAE, startups, growing companies, and SMEs rely on payroll outsourcing services to stay compliant while scaling their workforce. Payroll outsourcing in UAE works especially well for businesses managing diverse employee contracts, variable pay, or fast hiring cycles.

Key Payroll Functions Typically Outsourced

Providers calculate wages accurately while aligning with schemes such as the Emirati salary support scheme, ensuring correct payouts. These are the payroll functions usually outsourced:

- WPS compliance

- Payslips and reporting

- Leave and overtime calculation

- End of service benefits

Payroll outsourcing service providers handle wage file preparation and submission. This guarantees WPS compliance as salaries are transferred through approved channels on time.

With the third-party partners managing the payslips and reporting, employees receive clear breakdowns. Businesses can also access reports for audits and planning.

Leave and overtime calculations are accurate and follow the types of leaves in UAE, reducing disputes and manual corrections.

End-of-service benefits calculations are also managed by the providers. EOSB calculations follow approved formulas and remain ready when employees exit.

Why Payroll Outsourcing in UAE Is Crucial in 2026

Regulatory scrutiny continues to rise across the UAE. Authorities expect accuracy, transparency, and timely submissions. Even small errors attract attention.

Updates tied to Article 29 UAE Labour Law have changed how employers approach employee rights, wages, and records. Keeping pace requires constant monitoring, something most SMEs struggle to prioritize internally.

Digital payroll expectations have also evolved. Businesses must protect employee data, automate processes, and meet modern security standards. Manual systems no longer hold up.

Workforce expansion adds another layer. SMEs now hire across borders, manage remote teams, and juggle different employment terms. Payroll outsourcing process models built around workforce management help businesses adapt without disruption.

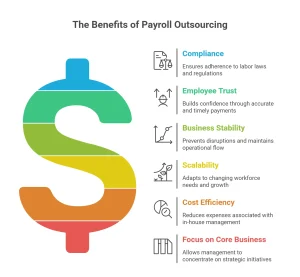

Benefits of Payroll Outsourcing for SMEs in UAE

Payroll outsourcing benefits for SMEs show up where it matters most. Time, focus, and peace of mind.

Cost Savings and Predictable Expenses

Reduce HR and accounting workload by shifting payroll responsibilities to experts. Many SMEs also pair payroll with outsourcing HR administration to centralize operations.

Avoid investing in payroll software, upgrades, and internal training. Outsourced models replace fluctuating internal costs with predictable service structures.

100 Percent Compliance with UAE Labor Laws

Payroll partners handle WPS submissions, MOHRE alignment, and wage protection requirements with precision.

Avoid penalties by relying on teams that monitor changes and apply them before issues arise. Payroll outsourcing benefits include risk reduction that internal teams often underestimate.

Time Efficiency and Focus on Core Business

Free your internal team from repetitive admin work. Redirect energy toward clients, products, and revenue. Support growth initiatives with better recruitment strategies while payroll runs quietly in the background.

Data Security and Confidentiality

Use secure payroll systems designed for sensitive data handling. Reduce internal access risks by limiting who sees employee financial information. This structure lowers exposure and builds trust.

How Payroll Outsourcing Works in UAE Step by Step

Understanding how payroll outsourcing works removes hesitation.

Selecting a Payroll Outsourcing Provider

Start by choosing from experienced payroll outsourcing companies with UAE-specific expertise. Look for proven compliance knowledge.

Employee Data Collection and System Setup

Share employee details securely. The provider sets up payroll systems aligned with your company structure.

Monthly Payroll Processing and Validation

Salaries, allowances, deductions, and leave data are processed and shared with you for review.

Salary Disbursement and WPS Filing

Approved payroll moves through WPS channels accurately and on schedule.

Reporting, Compliance, and Ongoing Support

Receive reports, audit support, and ongoing updates without chasing paperwork.

Payroll Outsourcing vs In House Payroll: A Comparison

In-house payroll often appears cheaper on paper, but it becomes more complex over time. Outsourced payroll offers clarity.

- Costs become predictable instead of fluctuating with staff turnover or system upgrades.

- Compliance responsibility shifts to specialists who track changes daily.

- Accuracy improves through automated checks and dedicated payroll teams.

- Risk management is strengthened by reducing dependency on a single internal resource.

This is why SME payroll outsourcing UAE continues to gain traction.

Key Factors to Consider When Choosing a Payroll Outsourcing Company in UAE

Consider these factors when you are choosing a payroll company in UAE:

- Experience with UAE labor laws matters

- Local knowledge prevents errors

- Strong WPS compliance expertise ensures smooth salary transfers

- Data security standards protect employee trust and business reputation

- Scalability supports growth without system changes

- Transparent support models help you understand what you receive and when

Common Myths About Payroll Outsourcing

Many believe payroll outsourcing is only for large companies. In reality, SMEs gain the most value.

Some fear loss of control. Outsourcing keeps the approval authority with you while removing the administrative burden.

Others assume it is expensive. In practice, payroll solutions for small businesses in UAE often cost less than maintaining internal systems.

Is Payroll Outsourcing the Right Choice for Your SME?

Review these points to see if payroll outsourcing is the right choice for your SME.”

- Consider your business size and team complexity

- Assess your growth plans

- Evaluate compliance workload

Conclusion

Payroll outsourcing delivers consistency, compliance, and scalability for SMEs navigating 2026. It reduces risk, protects data, and frees your team to focus on growth.

Many businesses already combine payroll with staff outsourcing services to simplify workforce management further. We see this approach work especially well for growing companies.

Our emiratisation gateway helps align payroll, compliance, and local workforce goals under one roof. If payroll feels heavier than it should, it may be time to talk to a professional payroll partner and build a smarter structure for long-term growth. Contact us now for our services.

FAQs Payroll Outsourcing in UAE

What is payroll outsourcing in UAE?

Payroll outsourcing in UAE means assigning payroll tasks such as salary processing, compliance, and reporting to an external provider.

Is payroll outsourcing legal in the UAE?

Yes. Payroll outsourcing operates within UAE laws when handled by compliant providers.

How much does payroll outsourcing cost for SMEs?

Costs vary based on company size, payroll complexity, and services required.

What are the benefits of payroll outsourcing?

Benefits include compliance assurance, time savings, reduced errors, and predictable payroll operations.

Does payroll outsourcing ensure WPS compliance?

Yes. Professional providers manage WPS files and submissions accurately.

Can startups and small businesses use payroll outsourcing?

Absolutely. Payroll management for SMEs in UAE often benefits startups the most.

What is the payroll management system?

It is the platform used to calculate salaries, track data, and generate reports securely.

How to choose the best payroll outsourcing company?

Look for UAE expertise, strong compliance records, secure systems, and scalable support.